TaylorMade-adidas Golf (TMaG), the largest and most profitable golf equipment, apparel and footwear company in the world, announced at the beginning of this month, Q2 sales of $454M (EUR 348M). During unseasonably poor weather across the globe leading to a late golf season start, TaylorMade reports sales of $1.012B (EUR 771.077M) with currency-neutral, year-over-year growth of +2% for the first half.

Sales increases were led by the iron and footwear categories, which each saw double-digit growth YTD of +16% and +18% respectively. Regionally, the U.S., which accounts for more than half of TaylorMade’s global sales, posted YTD year-on-year sales growth of +8%.

Leading the Q2 charge was the stellar growth in the footwear and iron categories. Footwear was driven by the success of the ultra-light family of adizero products, including adizero tour and adizero sport for both men and women.

TaylorMade keeps dominating the metalwood category with Rocketballz Stage 2 fairways, hybrids and driver and the R1 driver. With 37.8% market share of U.S. metalwood market share, TaylorMade holds more share than the #2 and #3 ranked manufacturers combined (source: Datatech June 2013).

Just an interesting background information, in Golf Datatech latest report we can find that dollar and unit sales of irons in May 2013 were the highest since June 2008 (unit sales) and May 2007 (dollar sales). For the month, iron sales totaled more than $72.4 million on more than 950,000 units sold (a 6.8% increase in units and 9.5% gain in dollars compared to May 2012).

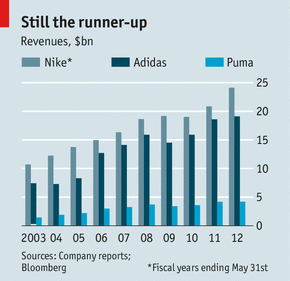

On group level (adidas Group) we can see also a steady growth in the last decade. Overall, the company wants €17 billion in sales by 2015, at the same time increasing operating-profit margins to 11% (from 8% now).

Some premium product manufacturers (e.g. Apple) recognize it is important to address the need of average people who cannot afford to buy premium products. The challenge is the following: how you can develop an alternative version of the same product on an affordable price without sacrificing and compromise on quality?

At some point every golf club consumer makes a marginal utility calculation. (Here I don't talk about hard core brand loyalists.) For the same reason I will not buy iPhone, but rather a Samsung Galaxy 4. If this prospect thinks in the same way as I do, then we created a new opportunity to our competitors (e.g. Nike Golf, Ping, Puma Golf, Callaway Golf etc.).

Why I am asking this?

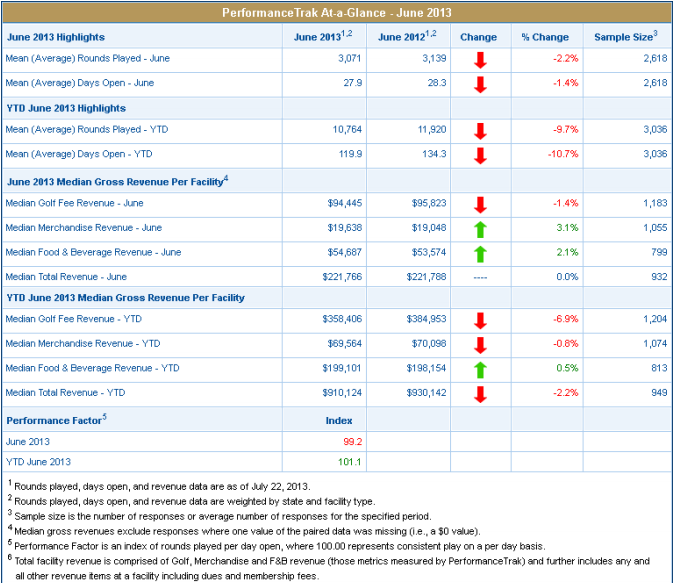

PGA PerformanceTrak reported about 9.7% decline in the number of rounds played at U.S. golf facilities during the first half of this year from the number posted in 2012. At the same time there was a little rebounding in participation the UK.