Back in March 2010 The New York Times wrote about the "Tiger Bubble" and warned us from the negative impacts ("But at some point the momentum shifts. Economic reality quickly catches up with the pervasive overconfidence that first set the bubble aloft, and it bursts.").

It seems to me that Jonathan Mahler the writer of the above mentioned article can be right. Last month I came to similar conclusion when I wrote about consquences on the golf industry and Nike Golf without Tiger Woods.

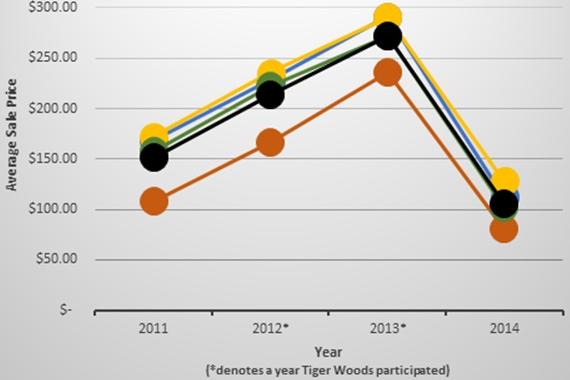

TicketCity has just reported that they see a drastic drop of 61% in U.S. Open Championship (Pinehurst Resort) ticket sales in comparison with last year when Tiger Woods did participate: the secondary market goes for $106.

At the same time, I would note that the presence of Tiger Woods is not a gurantee for profits for the organizers (e.g. USGA, Merion Golf Club). According to my source, last year, when Merion Golf Club hosted the U.S. Open, they finished with cca. 10 million USD loss.