Upon reviewing the latest Graffis Report from the National Golf Foundation, it became clear that a discussion with Erik Hultsberg, the Head of Simulator and Range at Sweetspot, was necessary.

Our conversation centered around how owners of indoor golf facilities can capitalize on the surging popularity of indoor golf.

What are the biggest challenges for indoor golf facilities in 2023?

I would like to highlight two challenges. I see them as both challenges and opportunities. The first one is increasing the overall customer base. In other words, get more golfers to try simulator golf.

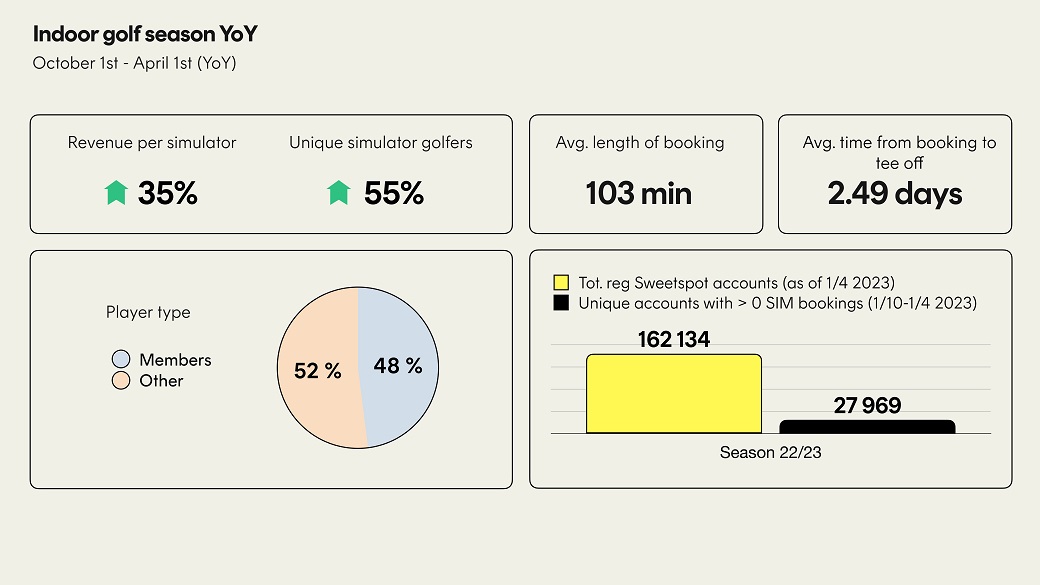

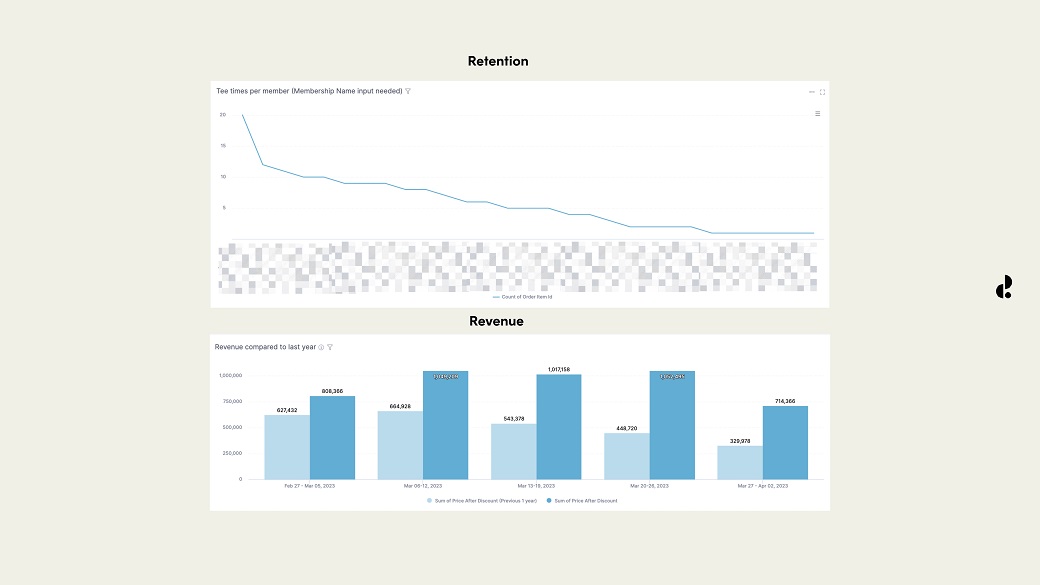

Our data tells us that customer retention is high but also that the vast majority of traditional golfers still haven’t tried out golf simulators.

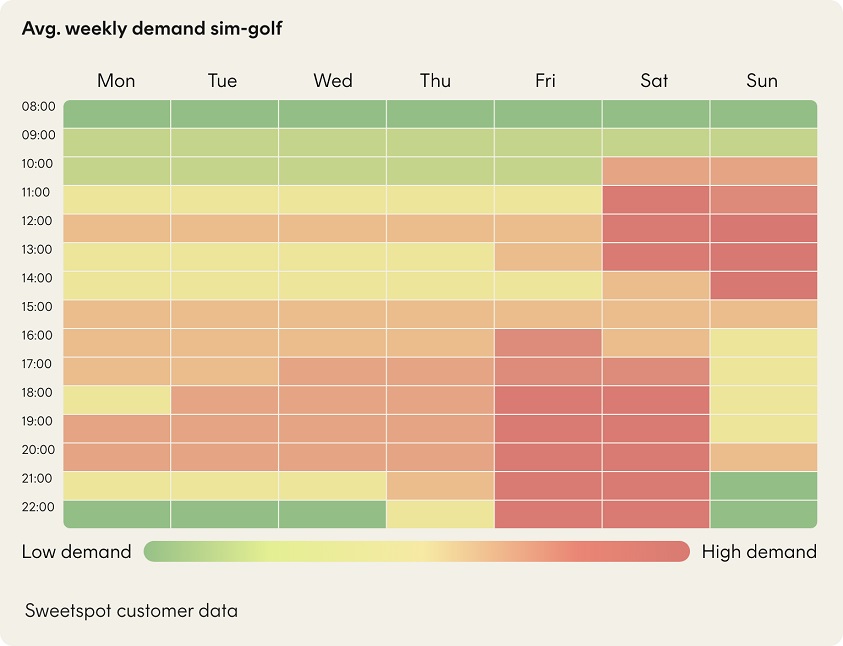

This presents both a challenge and an opportunity to grow your business. Another challenge is coping with and filling less demanded time slots, such as during working hours and the whole summer period.

How can indoor golf facilities maximize their revenues?

I would say using data to understand your business is the first key. Who are your customers, and what is the demand for your product?

Because this can differ quite drastically between customer groups, for example, hours, days, weekdays, and weekends.

The other key I would like to highlight is taking control of your inventory, i.e., your time slots, and then structuring your pricing and packaging based on that data.

This way, you can achieve enhanced occupancy, revenue, and customer loyalty.

What are the TOP 3 mistakes indoor golf facility operators are making?

First, I believe the concept of one size fits all is a common mistake. Our data, again, shows us that target groups and demand differ quite drastically. Based on actual data and insights, much can be gained from tailoring pricing and packaging.

Number two is the collaboration with golf clubs. I think there is an untapped opportunity and a clear win-win to be accomplished here. On the one hand, golf clubs lose revenue and risk losing members during winter, whereas indoor golf businesses have the same problems during summer.

They have overlapping target groups, and by collaborating, both partners ought to be able to gain new customers from the other party and better retain their current ones.

Lastly, I would like to highlight the fact that competition is growing, which requires more from business managers in terms of engagement.

Our data shows that facilities with a defined market positioning and strategy generally do much better than facilities that leave it more to chance.

Can you highlight some innovative indoor golf facilities?

Many innovative golf simulator businesses are doing well in their respective field. For example, Five Iron Golf has managed to become successful and found a scale in the more premium segment with food and beverage and so forth.

Indoor Golf Group here in Sweden has succeeded in the more scaled-down practice mode segment, where 15 of their 20 facilities are unmanned.

I believe the common denominator is that both of them have found their respective segment within indoor golf with a clear market positioning and strategy.

How can technologies help us personalize indoor golf facility pricing & services?

Well, the key element is data. Technology can help businesses gather data and present it in an understandable way, highlighting opportunities and challenges and so forth.

Good technology also provides the tools to optimize accordingly.

This interview is brought to you by Sweetspot, a revenue management platform for golf facilities (e.g., golf courses, driving ranges, indoor golf facilities)