If we look at what former and current PGA Tour stars are doing with their earned money we can see some similarities. E.g. launching a golf course design company, establishing a charity foundation.

Probably Jack Nicklaus has got the most diversified business (e.g. golf course design, children’s health care foundation, apparel, accessories, headwear, wine, golf ball, sunscreen & grooming products, Southeast Greens, etc.).

This is why it was a pleasant surprise to hear that Optum Ventures, Idinvest, and capital300 with participation from existing investors Balderton Capital and Heartcore Capital, as well as Symphony Ventures (an investment partnership with world #1 golfer Rory McIlroy), invested $26 million (Series B funding round) in Kaia Health.

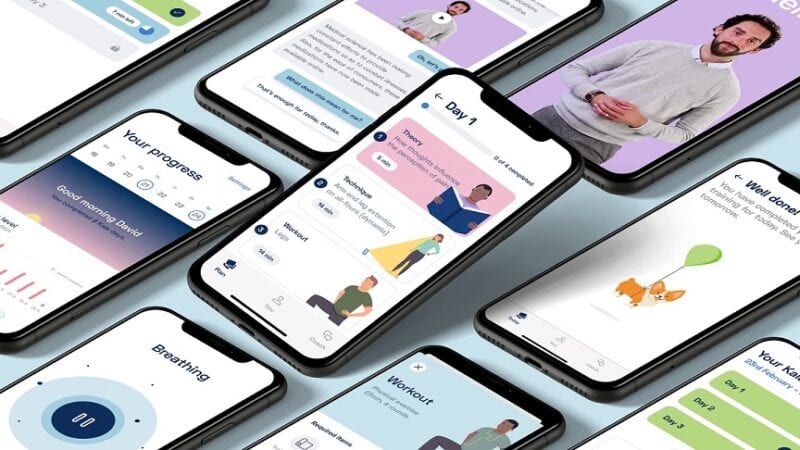

Kaia Health & digital therapeutics

The concept/idea behind Kaia Health is to offer an alternative to painkillers, using mobile technology. It creates evidence-based treatments for a range of disorders including back pain and COPD.

It has more than 400,000 users worldwide.

Kaia Health (founded in 2015) delivers multimodal, “mind-body therapy” for musculoskeletal (MSK) disorders. Back pain is one of the most typical golf injuries. I am sure you followed the saga of Tiger Woods‘ back surgery saga….

But I could list other injuries like:

- knee pains,

- rotator cuff,

- wrist injuries,

- neck, finger, and hand injuries,

- foot and anckle injuries, etc.

The app works by visually monitoring the user as they perform exercises (via their smartphone’s camera), enabling it to keep track of repetitions and also provide vocal feedback — to correct posture and motion.

Did you know?

Musculoskeletal (MSK) conditions are the #1 Cost Driver for the US Health System. 75% MSK spend is driven by overuse of expensive surgery and drugs

This is not the first investment of Rory McIlroy

In May, Rory McIlroy invested through Symphony Ventures in Golf Genius, which joined the private equity firm MVP Capital of Radnor, Pennsylvania, in the $5 million initial round of financing.